| Yearly | Monthly | Weekly | Daily | |

|---|---|---|---|---|

| Tax Free Allowance | £0 | £0 | £0 | £0 |

| Income Tax | £0 | £0 | £0 | £0 |

| National Insurance | £0 | £0 | £0 | £0 |

| Total Tax Due | £0 | £0 | £0 | £0 |

| Net Salary | £0 | £0 | £0 | £0 |

How your take-home is calculated?

How your income tax is calculated?

How your National Insurance is calculated?

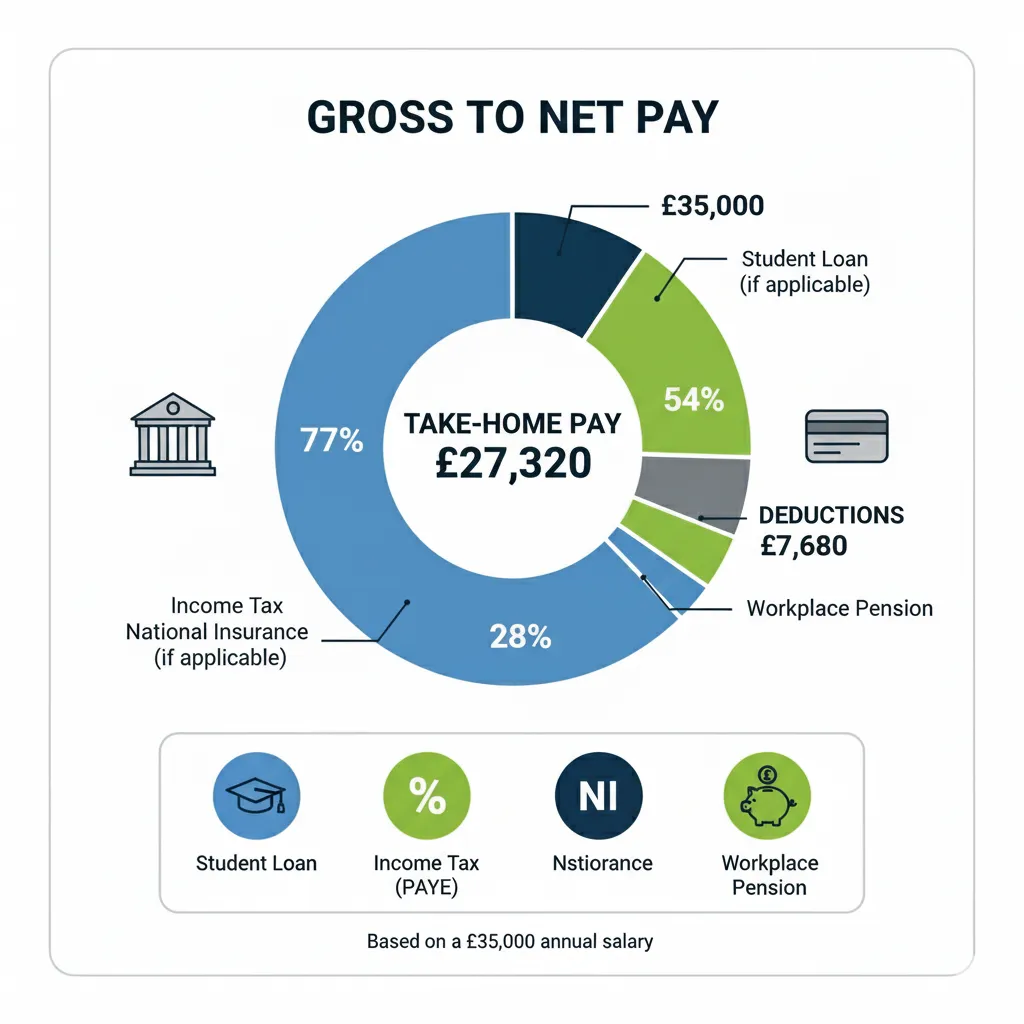

Your Salary From Gross to Net Pay

Your gross salary undergoes several deductions before reaching your bank account. The journey from gross to net involves mandatory contributions that fund public services and your future benefits. For accurate calculations, you can use UK gross to net pay calculator above.

For a £35,000 annual salary, you’ll take home approximately £27,320 after deductions. This means £7,680 goes toward Income Tax, National Insurance, and other contributions. The exact figure depends on your tax code, pension contributions, and student loan status.

Key deductions from your salary:

- Student loan repayments (if applicable)

- Income Tax through PAYE system

- National Insurance contributions

- Workplace pension (minimum 5% for auto-enrollment)

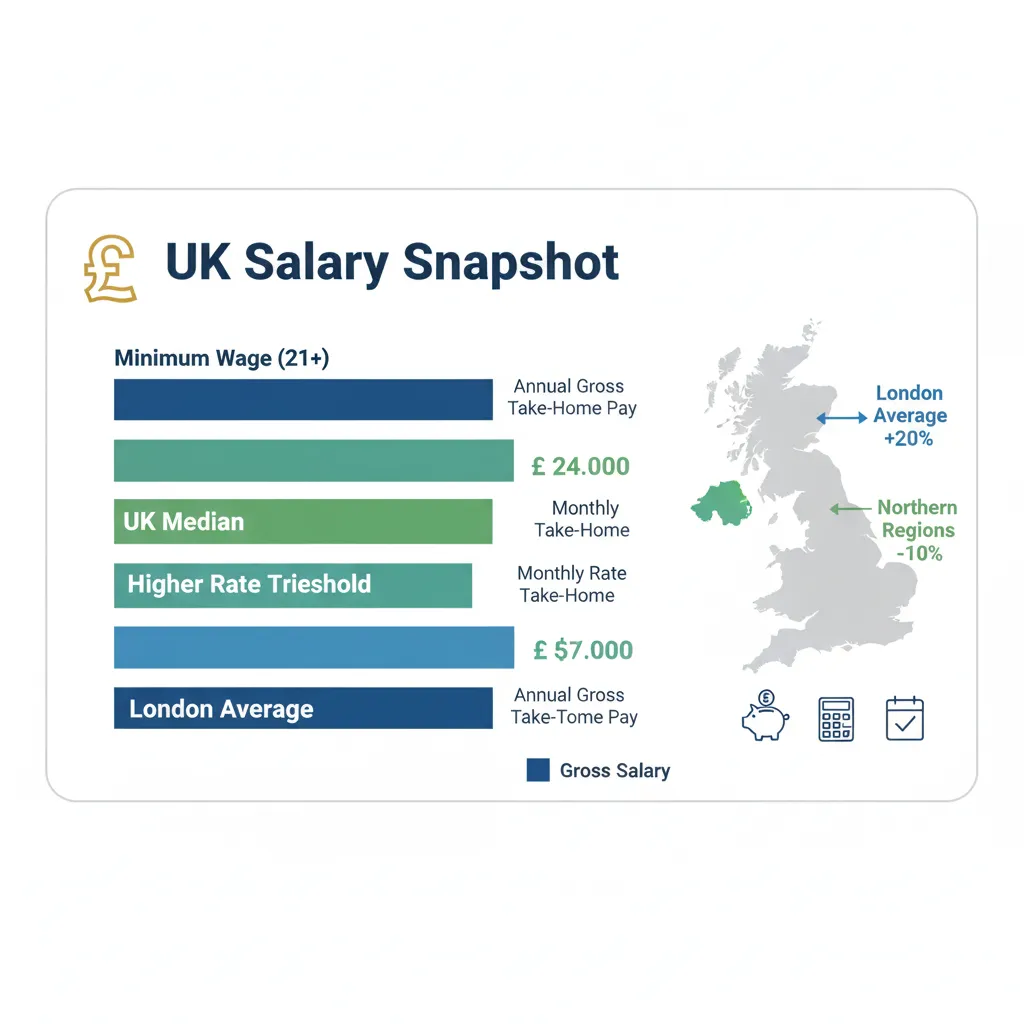

How Your Salary Compares in the UK?

The UK median salary stands at £34,528 before tax (£2,877 monthly). After standard deductions, this becomes approximately £27,320 annually or £2,277 monthly.

| Salary Level | Annual Gross | Monthly Take-Home |

| Minimum Wage (21+) | £22,308 | £1,632 |

| UK Median | £34,528 | £2,277 |

| Higher Rate Threshold | £50,270 | £3,099 |

| London Average | £41,000 | £2,620 |

Regional variations exist, with London salaries averaging 20% higher than the national median, while Northern regions typically sit 10% below.

Your Take-Home Pay, Your Financial Guide

Smart Budgeting

See your real net salary and apply rules like 50/30/20 to balance needs (rent, utilities), wants (entertainment, dinning out), and savings. Build a clear monthly plan with confidence.

Mortgage & Goals

Plan big decisions with your take-home pay. Lenders look at net income, so you can check affordability for housing. Try to keep housing cost below 28% of your take-home pay as your safety net.

Future Planning

Test salary changes, track savings, and build your emergency fund. The calculator shows how every adjustment impacts your finances in real time. Track progress monthly for better control.