Take Home Pay Calculator UK

Use our up-to-date salary calculator to see exactly what you’ll earn after tax, National Insurance, and other deductions for the 2025/2026 tax year.

Salary Information

BR: Basic rate (20%) – no allowance

D0: Higher rate (40%) – no allowance

D1: Additional rate (45%) – no allowance

NT: No tax deducted

Advanced settings

General

Overtime and extras

Family

Region and credits

Your Take Home Pay

Your Paycheck Breakdown Explained

Every pound deducted from your gross salary follows specific HMRC rules and thresholds. If you understand these deductions, it will empower you to make informed financial decisions and spot any errors in your payslip. Income tax takes the largest portion for most earners, followed by National Insurance contributions. Additional deductions depend on your personal circumstances, including pension contributions, student loan repayments, and any salary sacrifice schemes you participate in.

Your personal allowance plays a crucial role in determining your tax liability. For 2025/26, you can earn £12,570 tax-free. Every pound earned above this threshold gets taxed according to your income band. The more you earn, the higher percentage of tax you’ll pay on earnings above each threshold.

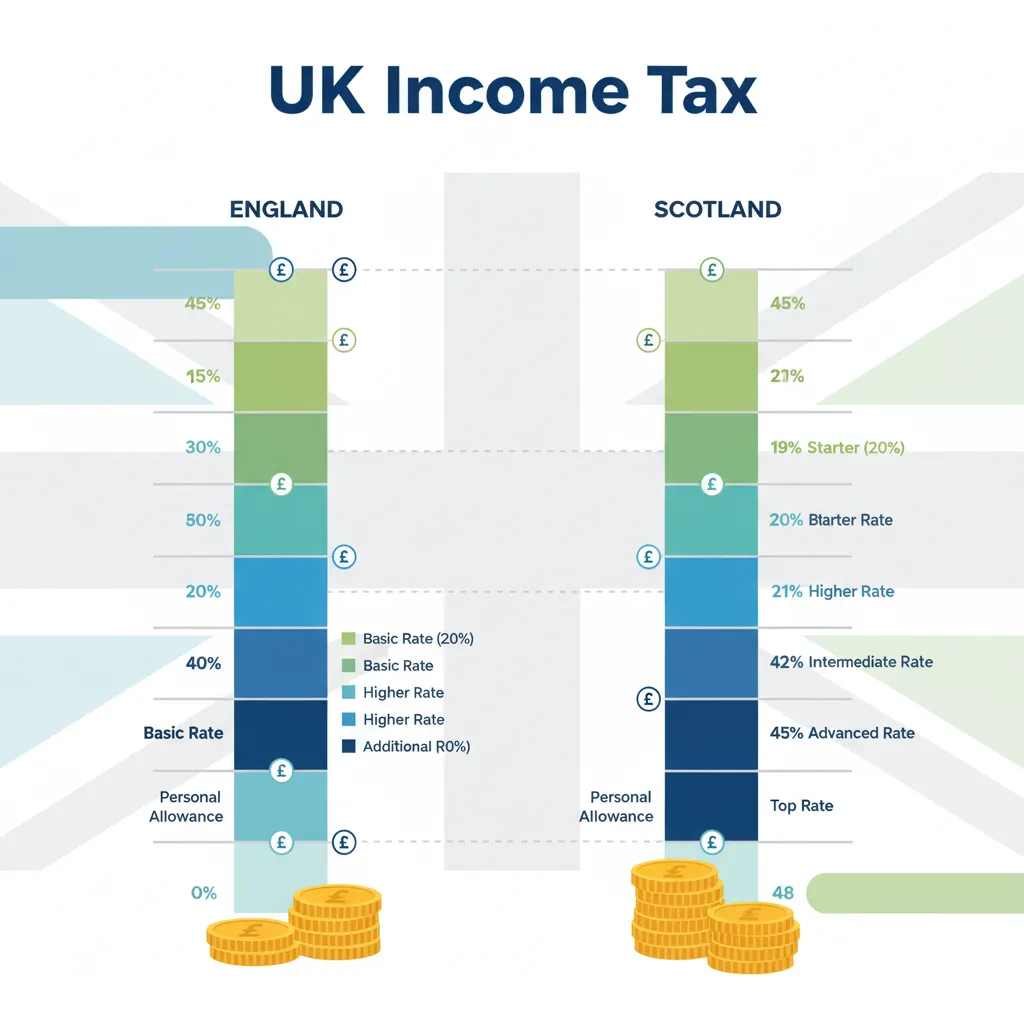

UK Income Tax Bands and Rates

Income tax operates through a progressive system where higher earnings face higher tax rates. Your tax band determines the percentage deducted from your earnings above specific thresholds.

| Tax Band | Taxable Income | Tax Rate | England, Wales & NI | Scotland |

|---|---|---|---|---|

| Personal Allowance | £0 – £12,570 | 0% | ✓ | ✓ |

| Starter Rate | £12,571 – £14,876 | 19% | – | ✓ |

| Basic Rate | £12,571 – £50,270 | 20% | ✓ | – |

| Basic Rate (Scotland) | £14,877 – £26,561 | 20% | – | ✓ |

| Intermediate Rate | £26,562 – £43,662 | 21% | – | ✓ |

| Higher Rate | £50,271 – £125,140 | 40% | ✓ | – |

| Higher Rate (Scotland) | £43,663 – £75,000 | 42% | – | ✓ |

| Advanced Rate | £75,001 – £125,140 | 45% | – | ✓ |

| Additional/Top Rate | Over £125,140 | 45% (48% Scotland) | ✓ | ✓ |

High earners face an additional consideration: the personal allowance reduction. For every £2 earned above £100,000, your personal allowance reduces by £1. This creates an effective 60% tax rate between £100,000 and £125,140.

National Insurance (NI) Contributions

National Insurance serves as your contribution toward state benefits, including the State Pension, Statutory Sick Pay, and Maternity Allowance. These contributions create your entitlement to these benefits throughout your working life and into retirement.

| NI Category | Weekly Earnings | Monthly Earnings | Rate |

| No contributions | Up to £242 | Up to £1,048 | 0% |

| Standard rate | £242.01 – £967 | £1,048.01 – £4,189 | 8% |

| Higher rate | Over £967 | Over £4,189 | 2% |

Your employer also pays National Insurance on your behalf at 13.8% on earnings above £175 per week. While this doesn’t affect your take-home pay, it represents a significant cost of employment that funds the UK’s social security system.

Different NI categories apply to specific circumstances. Category A covers most employees under State Pension age. Category C applies once you reach State Pension age, exempting you from employee contributions while your employer continues paying their share.

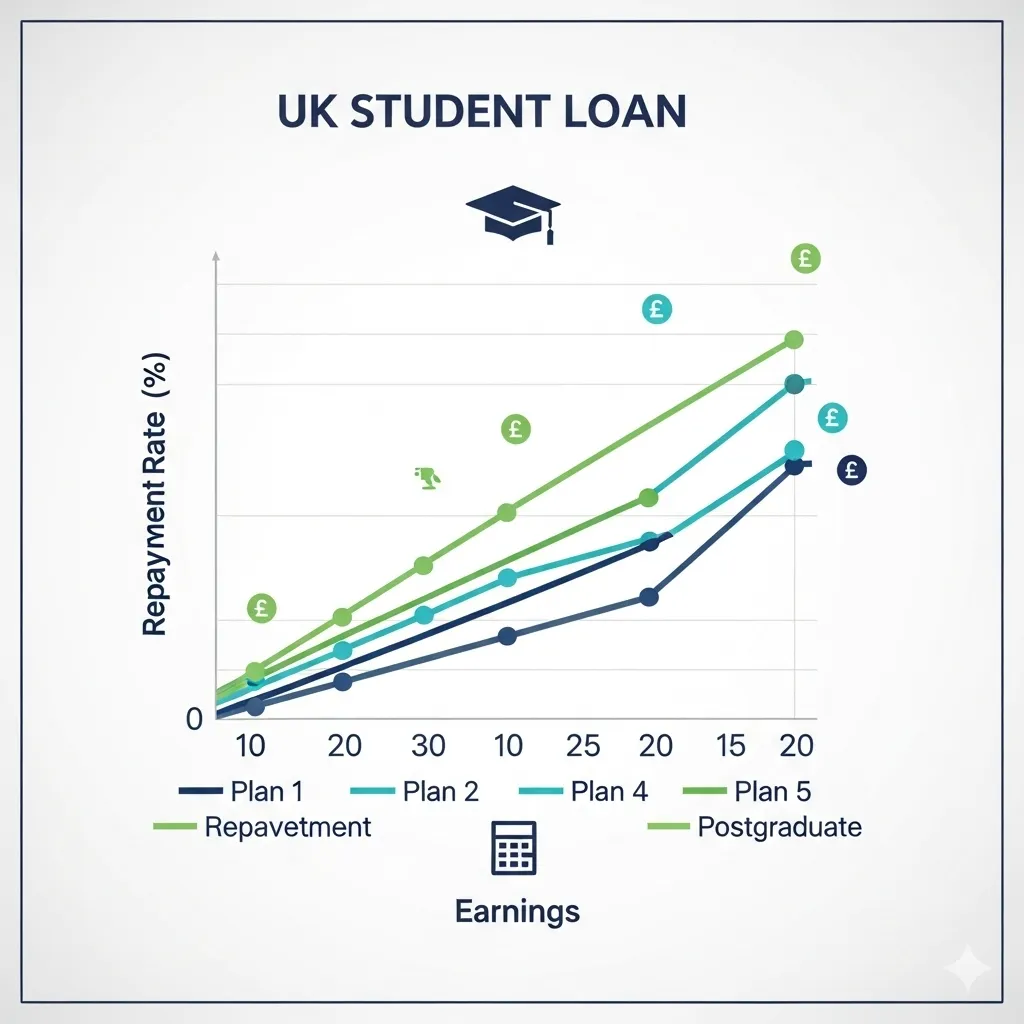

Student Loan Repayments

| Loan Plan | Annual Threshold | Repayment Rate | Who It Applies To |

| Plan 1 | £24,990 | 9% | Pre-2012 students (England, Wales, NI) |

| Plan 2 | £27,295 | 9% | Post-2012 students (England, Wales) |

| Plan 4 | £31,395 | 9% | All Scottish students |

| Plan 5 | £25,000 | 9% | English students starting after August 2023 |

| Postgraduate | £21,000 | 6% | Postgraduate loan holders |

Repayments only apply to income above the threshold. If you earn £30,000 on Plan 2, you’ll repay 9% of £2,705 (the amount above £27,295), equating to £243.45 annually or £20.29 monthly.

Multiple loan types mean multiple deductions. If you have both undergraduate and postgraduate loans, you’ll pay the relevant percentage for each loan type on income above their respective thresholds.

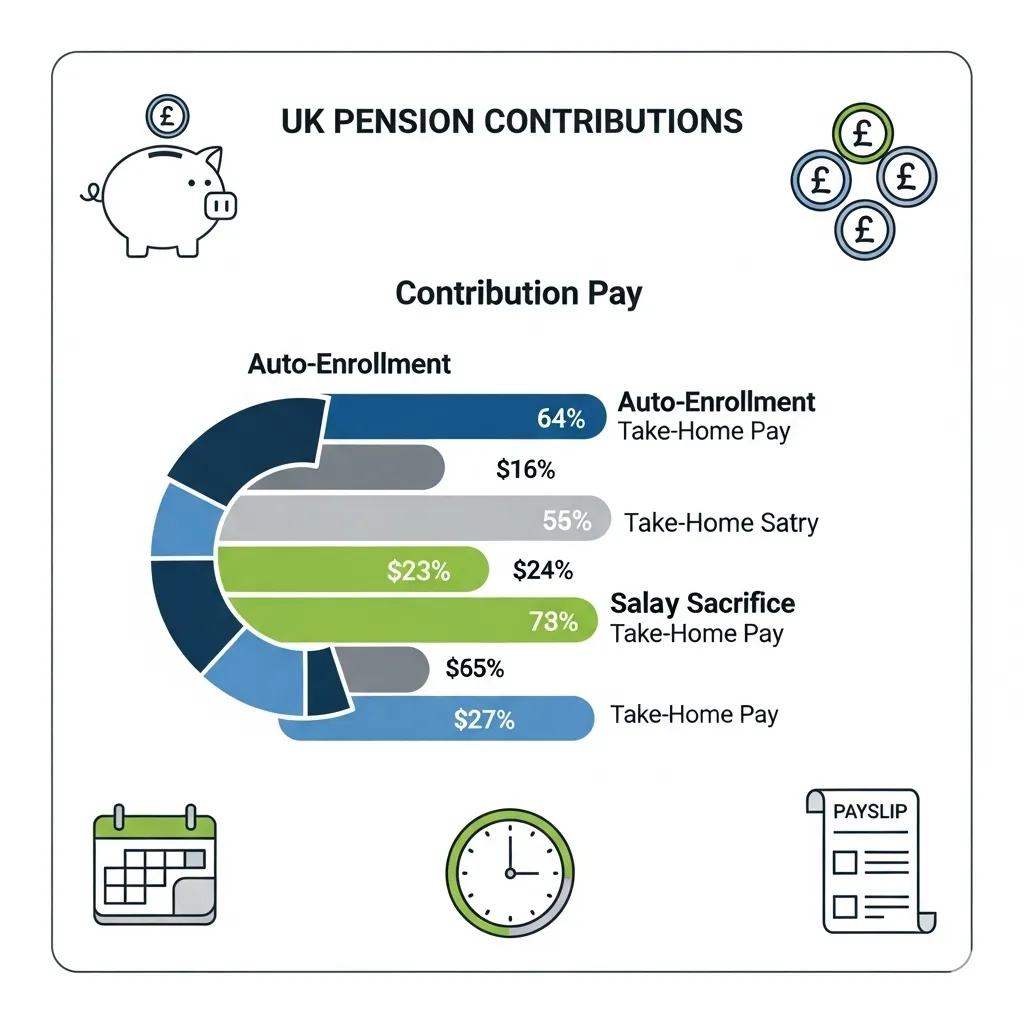

Pension Contributions

Workplace pension contributions reduce your taxable income to build up your retirement fund. Auto-enrollment means most employees contribute a minimum 5% of qualifying earnings, with employers adding at least 3%.

| Contribution Type | Tax Relief | NI Relief | Impact on Take-Home |

| Auto-enrollment | Yes | No | Reduces by contribution amount minus tax relief |

| Salary Sacrifice | Yes | Yes | Greater reduction but more tax savings |

| Personal Pension | Yes (claimed separately) | No | Full contribution deducted |

Qualifying earnings for auto-enrollment span from £6,240 to £50,270 annually. Only earnings within this band count toward the minimum contribution percentages.

Your Take-Home Pay, Your Financial Guide

Smart Budgeting

See your real net salary and apply rules like 50/30/20 to balance needs (rent, utilities), wants (entertainment, dinning out), and savings. Build a clear monthly plan with confidence.

Mortgage & Goals

Plan big decisions with your take-home pay. Lenders look at net income, so you can check affordability for housing. Try to keep housing cost below 28% of your take-home pay as your safety net.

Future Planning

Test salary changes, track savings, and build your emergency fund. The calculator shows how every adjustment impacts your finances in real time. Track progress monthly for better control.